Pay stubs are as important for you as they are in your personnel and contractors. When they visit practice for a mortgage, albeit for a car or a home, they’ll want to expose proof of earnings. They want those for their statistics while it comes time to pay their income taxes.

As an business enterprise, you will want them for the same motives—particularly for taxes. For example, each zone you will want to file your form 941, the corporation’s Quarterly Federal Tax go back. Among other things, you may need to account in your range of employees and their wages. Without the right documentation, this may be a almost impossible undertaking.

With proper pay stubs, you may be able to transfer information easily. Get your pay stubs proper the first time, and save yourself additional hurdles later. Here’s the way to create the correct pay stub.

Company info

The component in which you can get tripped up is your organisation identification range (EIN). This is the unique nine-digit wide variety assigned in your business by way of the IRS. You didn’t get into business to create pay stubs. We get it. It’s far a important piece of persevering with to be in enterprise. So in case you’re juggling more than one obligations without delay (as enterprise owners do), don’t pass over a digit on your EIN. Deal with your people by means of doing it correctly.

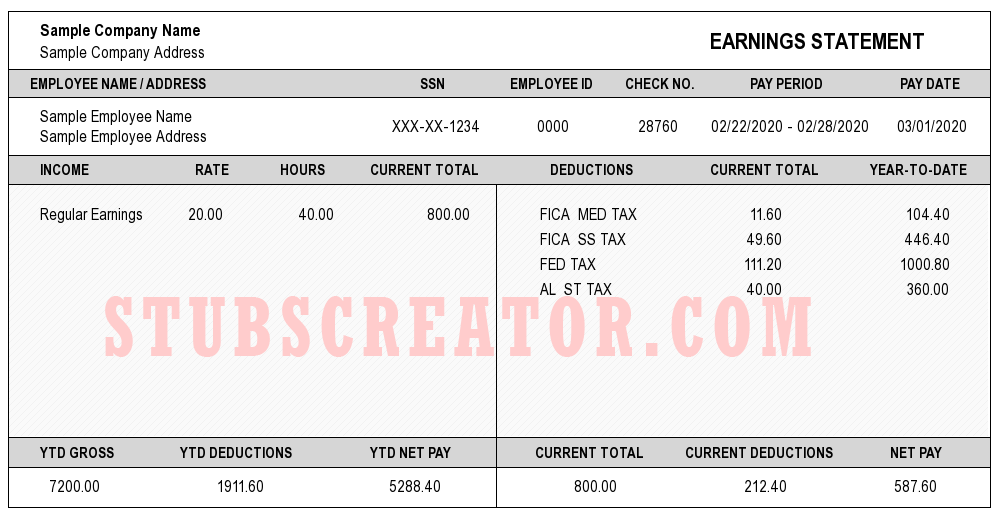

An additional bonus characteristic of the usage of a pay stub generator like stubscreator is the pay stub templates. There are twenty one of a kind pay stub templates to pick from that change with shade and format. Suit your enterprise’s aesthetic with our pay stub templates to offer them a customised experience.

Worker information

This is wherein the calculations start. Fill in their details (to be pulled from their W-9 or W-4).

To get a pay stub accurate, input in an appropriate wage they earn, their hours , and their filing status: unmarried or married. Again, this could be pulled from the W-4 or W-9 which you had them entire upon being hired.

Correct Taxes

With a pay stub generator like stubscreator, you will be able to see how your taxes and withholdings are being calculated. This consists of Federal and nation Withholdings, Social Security, and Medicare.

Regardless of a reliable and authentic pay stub generator like stubscreator, those taxes will handiest be as correct as the statistics you offer. That is to stress the importance of the first two sections we’ve mentioned. Every piece is a building block for the next.

Income and Deductions

This, too, is where a tremendous pay stub generator pays dividends. If you’ve executed your due diligence and entered inside the proper facts, income and deductions may be completed and presented to you.

With stubscreator, all you want to do on this section is input in the hours worked. You’ve already supplied their wages, and and then, you’ll see their overall earnings for the pay duration. You’ll see their yr-To-Date (YTD) totals. This extends to deductions as well. And much like wages, you may see the totals for the current pay stub and YTD.

Gross and Net PAY

As someone new to pay stub , these two terms would possibly confuse you. To create the precise pay stub, these two values are very critical.

Gross pay is the money paid out before deductions and taxes are taken out. Net PAY is what you taking home after tax deductions. While using stubscreator, you will have the benefit of seeing cutting-edge and YTD gross as well as current and YTD net.