Introduction

Being self-employed comes with a unique set of challenges, particularly when it comes to managing finances and providing proof of income. Unlike traditional employees who receive regular pay stubs, self-employed individuals often need to generate their own paystubs to document their income for various purposes, such as renting an apartment, applying for a loan, or filing taxes. In the United States, the Internal Revenue Service (IRS) uses Form 1099 to report income earned by independent contractors and freelancers. In this article, we will explore the importance of self-employed 1099 paystubs, their benefits, and how they can help individuals manage their financial affairs with confidence.

What are Self-Employed 1099 Paystubs?

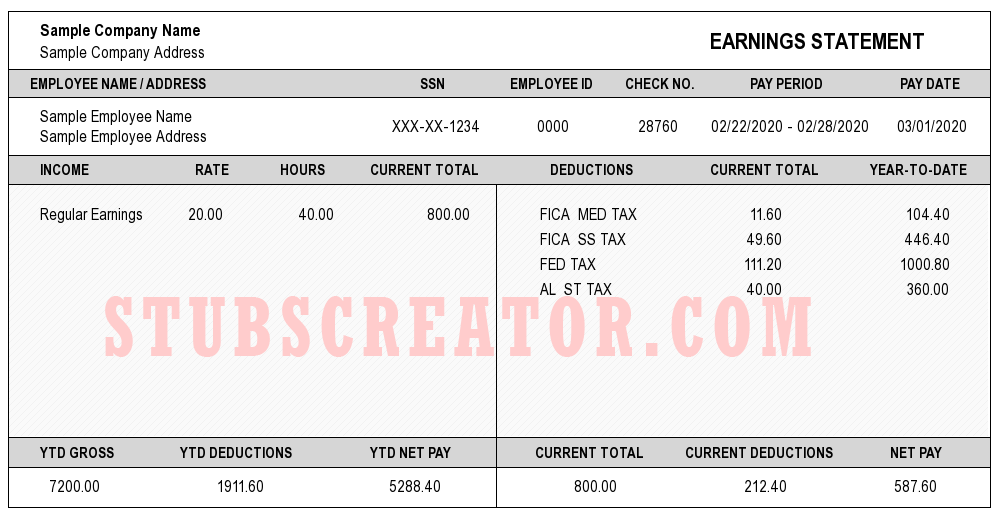

Self-employed 1099 paystubs are documents that serve as proof of income for individuals who work as independent contractors or freelancers. These paystubs provide a detailed breakdown of income earned, expenses, and deductions, similar to traditional pay stubs provided by employers to their employees. While self-employed individuals are not issued pay stubs by an employer, they can generate their own paystubs using various tools and templates available online.

Importance of Self-Employed 1099 Paystubs

Documentation for Financial Transactions: Self-employed 1099 paystubs play a crucial role in various financial transactions. When applying for a loan, renting an apartment, or leasing a vehicle, lenders and landlords often require proof of income. Having organized and accurate paystubs helps establish credibility and trustworthiness, making the process smoother and more efficient.

Tax Compliance: As a self-employed individual, filing accurate tax returns is essential. Self-employed 1099 paystubs provide a clear record of income earned and business expenses, making it easier to report accurate figures on tax forms. These paystubs can also be used to support deductions and claims for business-related expenses, ensuring compliance with tax regulations and maximizing tax benefits.

Budgeting and Financial Planning: Self-employed 1099 paystubs provide valuable insights into income patterns, allowing individuals to track their earnings and plan their finances effectively. By maintaining a record of income and expenses, self-employed individuals can create budgets, set financial goals, and make informed decisions about savings, investments, and business growth.

Benefits of Self-Employed 1099 Paystub Generators

Customization and Professionalism: Online paystub generators offer customizable templates that allow self-employed individuals to tailor their paystubs to their specific needs. These tools enable users to add their business logo, adjust fonts and colors, and include essential information such as name, address, and contact details. Customization adds a professional touch and reinforces brand identity.

Accuracy and Compliance: Self-employed paystub generators automatically calculate income, deductions, and taxes based on the information provided. This helps eliminate human errors and ensures compliance with tax regulations. Reputable generators stay up-to-date with tax laws and adjust their calculations accordingly, providing peace of mind when it comes to accurate and compliant paystubs.

Time and Cost Savings: Generating paystubs manually can be time-consuming and prone to errors. Self-employed paystub generators simplify the process, allowing individuals to create professional paystubs quickly and efficiently. This time-saving aspect frees up valuable time for self-employed individuals to focus on their core business activities. Additionally, using paystub generators is a cost-effective alternative to hiring accounting or payroll services.

Conclusion

For self-employed individuals, having organized and accurate financial records is vital for various reasons, including financial transactions, tax compliance, and financial planning. Self-employed 1099 paystubs serve as crucial documents to verify income and provide a clear breakdown of earnings and deductions. By using online paystub generators, self-employed individuals can create professional, customized, and compliant paystubs that help them manage their finances with confidence. These tools not only save time and costs but also ensure accuracy and provide a solid foundation for financial stability and growth in the self-employment journey.